PSP Investments Makes Significant Investment in Learning Care Group in Partnership with American Securities | Learning Care Group

Technical Analysis of PSP Investments' 2022 Responsible Investing Report — Shift - Protect Your Pension and the Planet

Alyssa Fangor - Analyst, Portfolio Analytics and Investment Support, Infrastructure and Private Equity - PSP Investments | LinkedIn

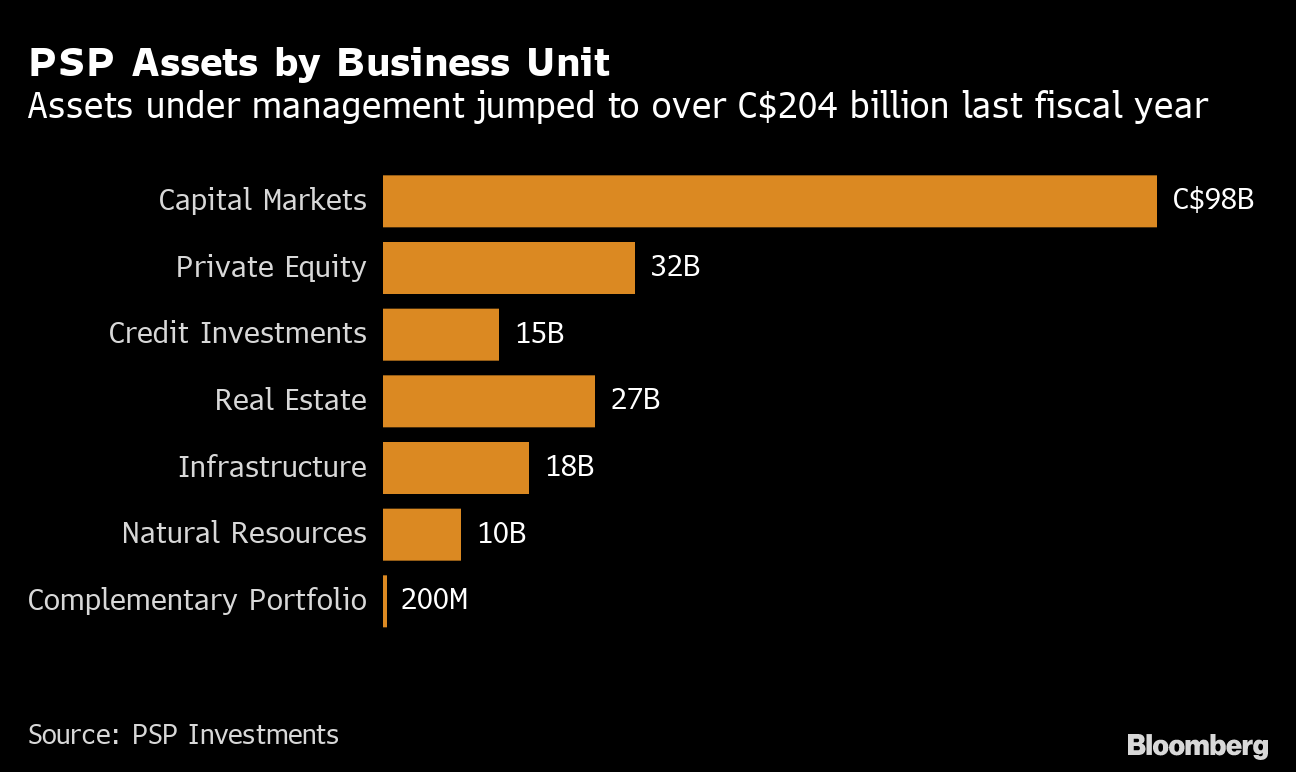

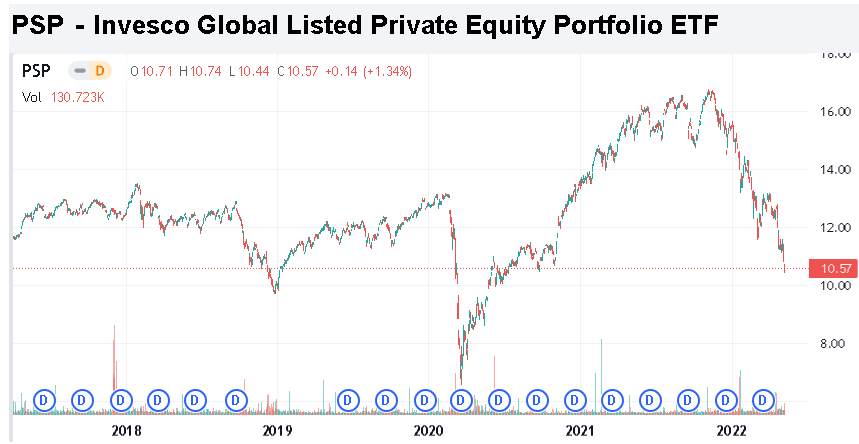

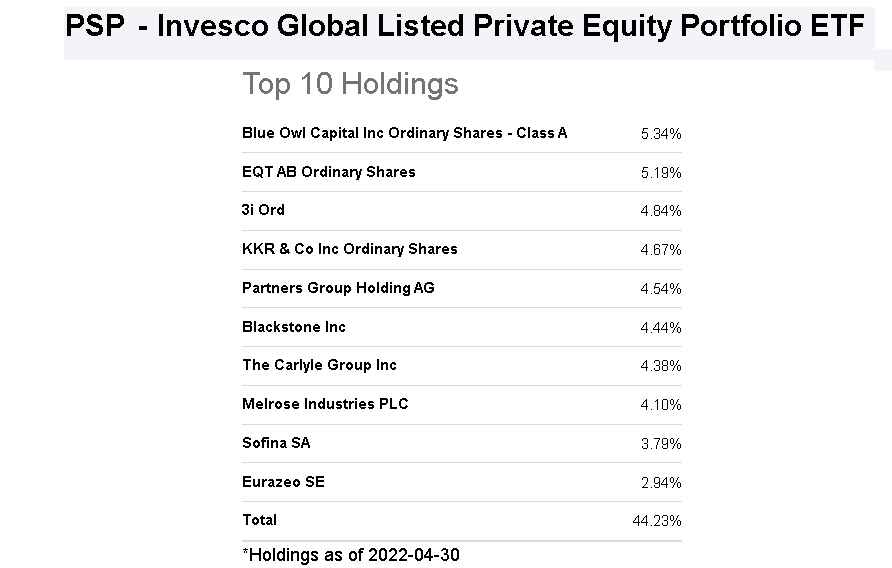

Invesco Global Listed Private Equity Portfolio ETF: Don't Count The PE Guys Out (PSP) | Seeking Alpha

InvestPSP on Twitter: "PSP Investments posted a 4.4% return in fiscal year 2023, demonstrating resilience and outperforming its Reference Portfolio in a challenging environment. News release >> https://t.co/zjgab3UYzs https://t.co/O9W5Fu6zJF ...

Technical Analysis of PSP Investments' 2022 Responsible Investing Report — Shift - Protect Your Pension and the Planet

Technical Analysis of PSP Investments' 2022 Responsible Investing Report — Shift - Protect Your Pension and the Planet

Invesco Global Listed Private Equity Portfolio ETF: Don't Count The PE Guys Out (PSP) | Seeking Alpha